Are Lottery Winnings Community Property?

Once you win the lottery, family you didn’t know you had will come call or visit, asking or begging for a piece of the pie. Saying no to a distant cousin is one thing, but what about a former spouse? If you and your partner are separated, in the process of seeking a divorce, or divorced, do you have to share your winnings with your ex?

Whether lottery winnings are considered community property depends on what state you live in. Nine states have community property laws, and the others use common law property to guide. Under community property laws, anything earned, including lottery winnings, must be divided equally.

Going through a divorce is a painful process, whether it is contested or not. Hopefully, understanding what it means to your lottery winnings if you live in either a community or common law state will help you as you decide how to move forward.

What Is Community Property?

Whenever dealing with legal matters, defining words and phrases is essential. Let’s start with simple definitions of marital, property, community property, and common law property.

- Marital property is considered the property a couple acquires while married. Since property laws differ by state, marital property is dealt with in two separate ways, common law, or community.

- Community property laws as related to divorce proceedings require that all marital property and assets that the couple earned while they were married need to be split 50-50.

- Common law property laws dictate that assets in a marriage belong to the person who earned or otherwise acquired them.

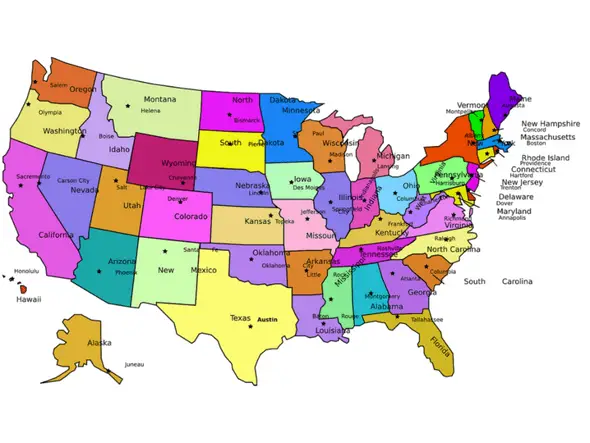

Which States Have Community Property Laws?

Most states are common law states, but these nine have community property laws:

- Arizona

- California

- Idaho

- Louisiana

- New Mexico

- Nevada

- Texas

- Washington

- Wisconsin

Three other states—Alaska, Tennessee, and Oklahoma—have systems in place where couples can create trusts where some or all their property can be in a community agreement.

In these states, anything earned while a couple is married will be evenly distributed at the divorce. There are exceptions, of course. In some instances, if you inherit property or received a gift, it might be something that you can keep. However, winnings from a lottery ticket you bought are not a gift.

What Is Treated As Community Property?

Pretty much everything that you or your couple earned or purchased during your marriage is community property. Although this does not apply directly to lottery winnings, your debt is also community “property,” and you and your spouse must pay that off equally. So your lottery winnings will be split in half, but any debts that cannot be paid off by the sale of the property will be taken out of those proceeds.

Stocks, IRA’s, and businesses are also community property. The division of those can get quite sticky, and you would be advised to get advice from lawyers if this is the case.

Texas Is a Modified Community Property State

Even though community property states are supposed to divide assets 50-50, judges in Texas do have discretion to divide property in what is a “just and right” manner. They can look at matters such as health, who is at fault, future earnings, and custody. In other words, your lottery winnings are probably community property in Texas, although there might be circumstances where it won’t be split in half.

If you are not unsure of what will happen, consult with an attorney.

Time and Community Property

An essential component of community property is time. When thinking about lottery winnings and who gets what, it’s important to consider four separate time periods:

- Before. Most property that belonged to you before you were married will go with you upon divorce. So if you bought that winning lottery ticket before you were married, you could keep all your winnings. Remember, though—that at best, you have one year to claim your winnings. So that lotto ticket you bought five years ago is worthless anyway.

- During. Pretty much anything that either of you earned or acquired during the marriage gets split 50-50. Things that are given to you, such as inheritance or outright gifts, are yours to keep. However, you cannot give yourself a lottery ticket.

- Limbo. In most states, the divorce is preceded by a separation time. The length of this varies from state to state. While you are separated, whether you must share your winnings is a difficult question to answer.

- Afterward. This one is the easiest. If you walk out of court newly single and buy a handful of Mega Million tickets and hit the jackpot, the winnings are yours.

Why Are Separation Guidelines More Complicated?

Separation guidelines vary from state to state. Additionally, there are different kinds of separations:

- Trial—in this separation, couples agree to live in separate places while they decide whether they wish to divorce or reconcile. Often this is not a legal separation. If nothing is put on paper, then anything you win will have to be shared.

- Permanent—couples in this process have decided that they plan to divorce but have not gone through a legal process. Because there have been no legal proceedings, property rights are complicated. Date of separation, date of filing, date of divorce—different jurisdictions use one or the other to decide how property will be divided. What happens to your lottery winnings in a permanent separation depends on your state’s laws.

- Legal—some states have a legal process, which means that the separation is entered into court, where the division of property and other matters are decided. The couple still must wait the amount of time required by the state they reside in before they are legally divorced. If you buy a ticket after these matters are decided, but before the date of divorce, it stands to reason those winnings are yours.

How Is Common Law Property Different?

The best way to think about common law is that assets are divided not by what is equal but what is equitable. Equal is a straightforward concept. Equitable is more complicated.

Equitable is typically defined as fair for both parties. Equal is 2 + 2 = 4. Equitable doesn’t have a simple equation. How fair is defined depends on who is defining it. You may think that the lottery winnings belong to you because you bought the ticket, but a judge may decide the winnings need to be split for any number of reasons.

In a common law state, if you purchase a new boat in your name, that boat is yours. However, if the boat is in both of your names, then it belongs to both of you, and dividing it upon divorce will be based on what you, your ex, your lawyers, and the judge decide is equitable.

Who Owns a Lottery Ticket?

Most lotteries consider a lottery a bearer instrument. This means that until a name is put onto a lottery ticket, it belongs to the person who is holding or bearing it. If you have ever had someone tell you to sign a winning ticket immediately, this is why. Once a ticket has been signed, it belongs to the person who signed it.

If you live in a community property state and are not yet divorced, it doesn’t matter whose name is on the ticket—you and your ex will share the winnings equally. If you live in a common law state, your signature makes the winnings yours. Remember, though, the division of those winnings will be done “equitably.”

Bottom Line

When dealing with legal matters, nothing is simple. Community property laws dictate that everything a couple earns is split fifty-fifty while common law property means the person who earned it keeps it.

So if you live in a community property state, then lottery winnings need to be split—if the ticket was bought before the lottery was finalized. In some ways, community property laws can make a divorce easier. You might not like that your ex will get half, but half is all he or she will get.

As you have seen, though, nothing in law is simple. If you are going through a disputed divorce, you hopefully have a lawyer. If not, now is an excellent time to get one.

Make that two lawyers—one for the divorce, and a second to deal with the taxes you will have to pay on your jackpot.