Do You Pay Taxes on Lottery Winnings Every Year?

So, you’ve hit the jackpot and won millions in the lottery. You know that the state and federal governments will get their hands on your money before it even hits your bank account. That means it’s a good idea to learn about the taxes you’ll have to pay so you can make good financial decisions.

The only time you pay taxes on lottery winnings every year is if you’ve chosen the annuity payment option. These yearly payments will count as taxable income at both the federal and state level (if your state collects lottery tax). Lump-sum winnings will only be taxed the year you claim your prize.

There’s a very complicated relationship between lottery winnings and taxes owed. So, let’s go over what you might owe in taxes. Then, we’ll talk about how this might impact you financially in the future.

The Federal Lottery Tax

You can’t expect to win millions in the lottery and owe absolutely nothing in taxes.

All lottery winnings valued at over $600 need to be reported to the IRS through the completion of a W-2G form when the tax filing season arrives. In addition, lottery prizes over $5,000 will have federal taxes withheld when you claim your winnings.

This federal tax withholding on lottery winnings is 24%.

But what you actually end up owing to the government on your winnings when you file your federal tax return will depend on just how much you won in the lottery. You also need to make sure that you’re claiming your winnings when you file your federal income tax return.

State Lottery Taxes

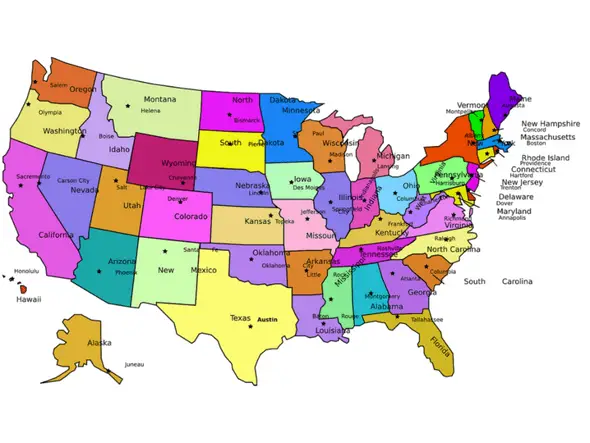

Along with having federal taxes on your lottery winnings withheld, there’s a good chance that you’ll also owe state and local lottery taxes. What you actually owe at the state level will depend on the state you bought the winning ticket in.

Some cities also tack on city taxes that’ll be deducted from your prize as well. For example, New York City will take close to an additional 4% out of your winnings in addition to your state and federal taxes.

There are actually some states in America where there aren’t state lottery taxes.

These states are:

- California

- Delaware

- Florida

- New Hampshire

- South Dakota

- Tennessee

- Texas

- Washington

- Wyoming

Puerto Rico also doesn’t require you to pay a lottery tax.

In each of these states, the only tax applied at the time of claiming your winnings will be the 24% in federal taxes. Eventual taxes and fees may apply, but you won’t owe any additional cash to the state when you claim your award.

States With Lottery Taxes

Most states in America have a lottery tax that’ll be removed from your winnings in addition to the federal taxes.

Here’s a look at the states with the highest lottery taxes:

- New York: 8.82%

- Maryland: 8.75%

- Washington DC: 8.5%

- New Jersey: 8.00%

- Wisconsin: 7.65%

So, if a winning lottery ticket is sold in New York, the winner would have the 24% federal tax deducted plus an additional 8.82% taken out due to the state lottery tax. If this ticket happened to be purchased in New York City, close to 4% will be taken out in the form of city tax.

That means you’d be sacrificing close to 37% of the total prize in this case.

The good news is that most states aren’t even close to the near 9% lottery tax that you’ll see in states like New York. For example, North Dakota currently has a lottery tax of 2.90% while Pennsylvania is a mere 3.07%

Some states also have additional state tax withholding if you’re an out-of-state resident.

When You Buy Tickets Out-of-State

If you purchased a winning lottery ticket valued at over $5,000 in your home state, then it’s pretty straightforward how much you’ll owe in terms of taxes. But it gets a little dicey if you purchased your winning ticket out of state.

Here’s what you need to know about this issue.

The state tax you owe on your lottery winnings will be deducted by the state where you actually purchased the ticket. But if your home state happens to have an even higher lottery tax, then you’ll owe the difference to your state come tax time.

On the other hand, if you live in a state where there’s no lottery tax, but you bought your ticket in a state where this is a lottery tax, you don’t get your money back.

Buying lottery tickets in your home state (when possible) makes everything a whole lot easier. It’s the best solution since you can’t avoid paying taxes by just buying your lottery ticket in a different state.

The Role of Tax Brackets

Lottery taxes seem pretty straightforward when you’re given a hard percentage that you’ll pay to the federal and state governments. The biggest issue comes when your winnings advance you to an even higher tax bracket.

Let’s go over what all of that means and how it might change what you owe.

What Is a Tax Bracket?

A tax bracket is where you fall in terms of how much money you make in income on an annual basis and how much in taxes you owe the government. The more income you generate, the greater percentage you’ll owe in taxes.

Here’s a look at what you’ll owe in federal taxes based on the income you make (if you’re filing with a single status).

| The Tax Rate | Income |

| 10% | $0 to $9,700 |

| 12% | $9,701 to $39,475 |

| 22% | $39,476 to $84,200 |

| 24% | $84,201 to $160,725 |

| 32% | $160,726 to $204,100 |

| 35% | $204,101 to $510,300 |

| 37% | $510,301 or more |

Note: Filing a joint tax return adjusts the income requirements for each tax bracket.

How Tax Brackets Really Work

While this seems easy enough to figure out with a chart, it’s actually a little more complicated than what it looks like. That’s because your tax rate isn’t a flat rate.

So, earning $40,000 a year doesn’t mean that you’re paying just 22% on your entire income.

Here’s how it works:

- The first $9,700 of your income will be taxed 10%

- Any income between $9,701 to $39,475 will be taxed at 12%

- The income you earn between $39,476 and $84,200 will be taxed at 22%

That means having a higher income requires you to give up a larger chunk of your income to the federal government.

How This Relates to Lottery Winnings

Since the federal government views your lottery winnings as taxable income, there’s a slight chance that winning over $5,000 will change where you fall in your tax bracket. So, you might owe an even higher tax on your winnings than you’re paying based on your current income.

The more income you bring in each year from lottery winnings, the more money you’ll owe the federal government.

That means cashing in on a lump-sum payment for a $10,000,000 lottery prize will force you to pay 37% federal tax on a majority of your winnings. On the other hand, accepting annuity payments might only advance you up one tax bracket.

The Different Types of Lottery Winnings

The government already takes enough out of your income if you live in a majority of states in America. That means the last thing you want to do is pay even more in taxes, whether that means paying taxes several times on your winnings or paying more in taxes in total.

Both lump-sum prizes and annuity prizes have their own advantages and disadvantages. Let’s talk about what that means in terms of taxes.

Lump-Sum Prizes

You know that winning $500,000,000 in the Mega Millions lottery doesn’t mean that you’ll end up with half a billion in your bank account.

As we already went over, you’ll have to sacrifice 24% of your winnings to go toward federal taxes and up to 9% in state taxes (depending on where you bought your ticket).

But that’s not all you owe in taxes on your lump-sum payment.

The more you earn in a single year in terms of income, the higher the tax rates you owe to the federal government. So, lottery winnings that exceed $510,301 will be taxed at the highest income tax rate of 37%.

Now, that’s not an additional 37% that you owe to the federal government. Since 24% was already taken out of your winnings at the time you claimed your award, you would only owe an additional 13% in federal taxes.

Let’s calculate approximately how much you would take home with a lump-sum payment for a prize of $500,000,000:

- Winnings: $500,000,000

- Subtract State Tax (8.82% in NY, for example): - $44,100,000

- Subtract Federal Tax (37%): - $185,000,000

- Total Take-Home: $270,900,000

This calculation is obviously an estimate since you have to factor in the lower tax rates seen in the lower tax brackets. But you can see that a lump-sum payment might leave you with about 50% of your total winnings in the lottery by the end.

What’s great about the lump-sum payment is that you only owe these taxes once.

You’ll owe the federal and state taxes on the year you claim your prize and won’t owe additional fees or taxes in the future. This makes it easier in terms of managing your finances.

Annuity Prizes

Claiming an annuity prize is definitely a whole different ball game, as compared to lump-sum lottery payments. In most states, your winnings in the lottery will be split up into payments over the next 25 to 30 years.

This also impacts how taxes are taken out.

Since you’ll be seeing an annual deposit to your bank account with an annuity prize, you’ll have to pay taxes on what you’re receiving every single year.

This annual tax won’t be much if you haven’t moved to the highest tax bracket.

Now, this might seem like a pain in terms of maintaining your finances and keeping track of your funds. But since you’re receiving less money every year, you might not find yourself in that 37% federal tax bracket like you would if you chose a lump-sum.

That means accepting an annuity payout on lottery winnings where you’ll receive less than $500,000 with each annual payment might secure you more money in the long-run.

Let’s calculate it out:

- Winnings: $2,000,000

- Annual Payments Before Taxes (25 years): $80,000

- Subtract State Tax (8.82% in NY, for example): - $7,056

- Subtract Federal Tax (22%): - $17,600

- Total Take-Home Each Year: $55,344

In total, for a $2,000,000 prize, you’d be walking away with about 70% of your total winnings over the 25-year payout period. This exact value will obviously depend on which tax brackets you end up in.

This serves as a better solution if you’re on the younger side and would like to guarantee greater lifetime earnings.

Lowering Your Lottery Taxes

Cashing in on a $100,000,000 lottery prize will probably give you financial security for the rest of your life. But you might be looking to save as much of this win as possible, especially in the form of cutting down on the taxes you owe.

You can’t negotiate the 24% federal tax rate and your state’s lottery tax fee. What you can do is work around the federal gift tax.

What a Gift Tax Is

Once you cash in on your lottery winnings, there’s a good chance that old friends and family will come out of the woodwork to mooch some of your winnings. But you might be looking to give some money or expensive gifts to those closest to you.

Beware, you might have to pay a gift tax.

And this can cost you up to 40% in taxes on what you choose to give away.

The IRS sets strict rules for what counts as a gift and how much you’re allowed to give out tax-free on a yearly basis. The general rule of thumb is that you can give $15,000 in cash and gifts per person per year.

Though you might want to report these gifts to the IRS just in case, you won’t owe any gift tax if you’re staying within this $15,000 limit per person.

Getting Around the Gift Tax

Getting around the federal gift tax is entirely legal, but you might want to enlist the help of a financial expert to be sure that you’re remaining in the guidelines.

The way around this gift tax is the lifetime gift tax exemption.

The government sets a limit for how much in gifts you can give away over the course of your lifetime. As of 2020, this maximum gift value is approaching $12,000,000.

So, if you’re choosing to give gifts that are greater than $15,000 per year, per person, here’s what you need to do:

- Report it to the IRS by filling out the appropriate forms come tax filing season.

- Apply anything above the $15,000 to your lifetime gift tax exclusion.

- Be aware that going over the lifetime gift tax exclusion might impact your estate.

The most important thing you can do is report your gifts to the IRS to avoid any tax penalties or possible legal consequences. The last thing you want is to look like you’re avoiding taxes.

Other Possible Deductions

Now that you know how often you’ll pay your taxes on your lottery winnings, you probably assume that you’re in the clear and ready to accept your prize. But you might have to give up even more money before you can cash in.

The IRS will first check if you have any debts that you owe the government.

Where You’ll Lose More Money

The government will take any unpaid alimony and child support payments out of your lottery winnings and pay them to the appropriate parties.

Coming into a good sum of money with a lottery win might also impact your current child support and future alimony payments. So, be prepared to shell out even more of your winnings if you happen to have one of these plans in place.

You’ll be able to claim winnings on whatever is left over after your debts to the government have been paid. This is likely going to be most significant if the prize you won is closer to the lower threshold of $600.

Conclusion

How often you pay taxes on your lottery winnings depends on the type of prize you end up accepting. A lump-sum payment will require you to pay the federal, state, and possible city taxes during the year that you accept your winnings. Annuity payment plans will require you to pay taxes on your annual installments.

You also might be on the hook for up to 40% in taxes for gift taxes if you’re not planning out your finances correctly. You should also expect to see less from your winnings if you currently owe in debt, such as child support or alimony.