Here’s What Happens When You Win the Lottery

Not very many people win the lottery, so it’s not exactly common knowledge as to what happens if you were to win. What is the procedure that winners go through, and how and when do they get their money?

Here’s what happens when you win the lottery: after the winning number is announced, claimants have at least 180 days to claim their prize. When they do, they fill out paperwork, choose how they will get their money, decide to be part of a press conference, and hire a team to help manage the money.

Keep reading to see what comes next if you become the next lucky winner of a multi-million dollar lottery.

The Winning Number Is Announced

You may have played the lottery for years and never won a thing. So you never really thought you would win this time either. Except, you did. The numbers announced match your ticket, and you’ve won a massive jackpot! Your financial worries are over.

Only now, what are you supposed to do? Where do you go, and what happens next?

Before You Claim Your Prize

First, take a deep breath and try to calm yourself. You don’t have the luxury to go crazy and tell everyone you know about your lucky win.

Second, check the back of your ticket to see how long you have before you need to claim your prize. The minimum for most states is 180 days, while some states give you a full year before stepping up to claim your prize.

Third, consult a lawyer immediately to determine if you can set up a trust fund or claim it anonymously to protect your privacy. Ask if you need to sign your ticket, or can you have your trust fund sign your ticket.

Some state lotteries allow others on your behalf to sign, while other states require you to sign it. Either way, make copies of your ticket and take pictures of it to validify that it is legally your ticket. Then secure the original, even after you sign it.

Where to Claim Your Prize

With the smaller lottery wins, you can claim your prize at any regional lottery office. However, with the Powerball or Mega Millions lottery, you need to go directly to their headquarters. The address should be somewhere on your ticket.

However, if your prize is under $600, you can go to the local retailer where you bought the ticket to claim your prize. Otherwise, most local, regional, or state offices can help you.

How to Claim Your Prize

The first thing to do, if you haven’t already done this, is to sign your ticket, as this represents the legal holder.

With the more significant jackpot lotteries, such as Powerball or Mega Millions, you have up to 60 days to decide how you’re going to accept your winnings—lump sum or annuity payments. Texas is different, though, as they require you to choose which type of payment you want before you even buy your ticket.

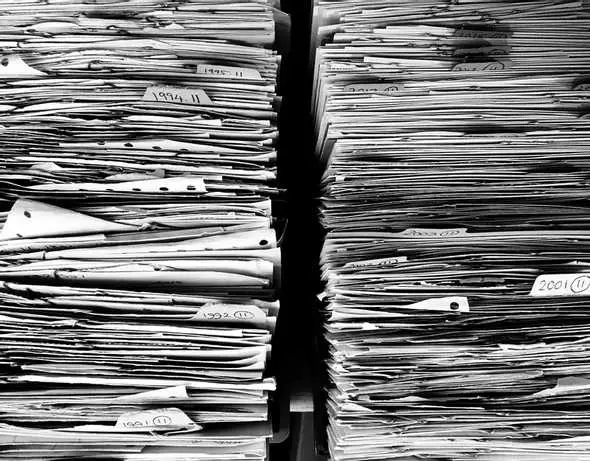

Once you’re ready to claim your prize, you will then need to fill out stacks and stacks of paperwork.

Miles of Paperwork

It is said that paperwork is the most stressful part of winning the lottery. Well that, and all the people knocking on your door looking for a handout. But, once you get that done, you will have the rest of your life to get used to being wealthy.

Don’t worry if there seems to be a mountain of paperwork. The officials are there to help you and will explain anything you don’t understand. Feel free to ask them any questions you like, as this is important to get right, with no mistakes.

Claim Form

The one-page claim form asks you for your name, address, etc., and to have you testify whether you are an employee or related to an employee of a lottery retailer. Then you will sign your name and date it.

The form is there to make sure everything is legal, and you aren’t committing a fraudulent act.

Game Accounting Office Forms

The accounting office will also have some forms for you to fill out. These will likely be forms to get your bank account for direct deposit and other general forms to keep everyone’s payments straight. Don’t worry if you don’t know what you are doing. They will explain things to you as you go.

Tax Forms

You will pay federal and state taxes on your win, so you need to fill out a few tax forms. The most common form will be a W-9, which most contractors and freelancers use before starting a job. Filling out these forms keeps you out of hot water when it comes time to pay your taxes.

When you receive a lump sum payment, you only pay on your prize once, but it will take a more substantial portion than if you chose the annuity payments. With the annuity, you pay income taxes on your annual payment like you would your salary from a job.

Should there be any other tax forms, the lottery office will let you know.

Press Conference?

The last thing that will happen when you are at the lottery office is that they will ask you whether you want to be at a press conference.

Before they ask you that, however, they will ask questions such as:

- How many tickets did you buy before you won?

- When did you find out that you won?

- What are your plans for your prize money?

These questions are used to write a press release about you.

If you do choose to attend a press conference, know that it is about 15 minutes long, and is held after your ticket is validated by the lottery office’s confidential validation requirements. Most conferences are supposed to be fun and exciting.

If you don’t choose to participate in the conference for privacy reasons, keep in mind that, if you’re not in a state where you are allowed to stay anonymous, your name and hometown will be released to the media. They say that it is required to prove that lottery games are fair and have integrity.

Even if you choose not to attend a press conference, the media may still try to contact you at home or at your place of employment.

Put Together a Team

Either before or after you claim your ticket, you will need a team of professionals on your side, helping you manage the consequences of being filthy rich. Taxes on any property you buy could be astronomical and could eat into your prize money.

You will also need a good lawyer that can help you protect yourself against frivolous lawsuits, dealing with the public, and creating any trust funds that you choose to set up.

You may also want a good therapist on your team. Why? Because after going through the emotional roller coaster of actually winning a massive sum of money, you may need to talk about several things. Even the most healthy people sometimes need to talk about and process through stress.

Lawyers

You need at least one good lawyer, if not a team of lawyers, to advise you through the preliminary steps of getting set up for success with your money. Not just any lawyer will do, however, as most don’t have the experience of working massive amounts of money, especially from a lottery win.

Look for a lawyer who specializes in lottery wins. There are not that many around since not too many people win the lottery. Still, there are a few, and it is worth it to seek them out, so they can help you navigate the many hurdles that come with this much money.

But take a word of caution: Not all lawyers have your best interests at heart and will try to work for a percentage of your winnings. Don’t let them do that. Pay their fees, but don’t agree to the percentage.

Tax Advisors

Do you have experience with taxes on large sums of money? No? Then you need a tax advisor on your team that does have that kind of experience. A good tax advisor can help you make all the right decisions for choosing the type of payment to get when claiming your prize, making large purchases after getting your money, and setting up your estate later when you die.

While financial advisors can give you some advice on those things, the tax advisor will tell you the tax consequences you take. For example, if you were to buy a large piece of property with a 10,000 square foot house, your tax advisor can tell you if it is a smart decision based on the property taxes alone.

They can also advise you as to what the inheritance taxes would be on that same property when you pass away and leave it to your heirs.

These types of decisions are essential, as you could end up owing more money to the government than you have, as was the case of Alex and Rhoda Toth. Alex bought a lottery ticket in 1990 and won $13 million. They insisted that this win would not change their lifestyle, but it did for a while.

He and his wife lived in costly hotels in Vegas for three months while they gambled, dined in fancy restaurants, and lived a good life. But when they got tired of that life, they went back home and settled in a double-wide trailer on ten acres of land.

But, after three years, they declared bankruptcy. Their troubles didn’t stop there, however. They also filed fraudulent tax returns, claiming gambling losses so they wouldn’t be required to pay taxes on their annuity payments. They owed several million dollars in back taxes.

Rhoda was sentenced with two years in prison and a $1.1 million fine, while Alex died penniless a few short years later.

Stories like these should tell you how important it is to have a tax advisor that can guide you through the never-ending circle of taxes that come with every move you make. If Alex and Rhoda had assembled a team and got advice on how to make their money last, they would not have been in the situation.

Get a tax advisor. It will be worth it.

Financial Advisors

Much like a tax advisor, a financial advisor can also guide you in creating a financial plan that works best. However, a financial advisor can also help you make sound investments, if trustworthy and honorable. Some financial advisors are not completely honest with their advice, so you need to interview each one to find the right one.

Also, don’t work with an advisor who works on commissions with financial products, as they will work harder to sell you financial products that you don’t need. Work with an advisor that makes their money through fees only, as they will be more likely, to be honest with you.

Therapist?

Do you need a therapist on your team? Considering the many people who went bankrupt or died of drug or alcohol overdoses after winning the lottery, it may be in your best interest to include one.

A therapist can help you process the many emotions and thoughts that happen as a result of a big win and keep you grounded while making the most important decisions of your life. You will go through an emotional roller coaster before you even claim your money. Once you get your money, there will be another wave of emotions to deal with.

You may be tempted to be very generous with your money and give it all away to family or friends, or even to a political party. Before you do, you need to speak with a therapist to help you realize that perhaps it isn’t such a good idea to be as generous as you want to be at first.

Or, you may have some mental health issues before winning. Do you think that your mental health will get better when you hit the big jackpot? Not likely, as several past winners discovered.

One estranged couple shared a $34 million jackpot in 2000. They both bought extravagant homes and lived glamorous lives for a few years. But three years later, they both died from either alcohol or drugs.

Had they placed a therapist on their team of advisors, they could have worked through the issues they faced before letting it get to that point. Your mental health issues will be magnified with a lot of money, as it will change you to a point. If you don’t have excellent mental health before buying a lottery ticket, don’t expect it to change if you win.

A therapist is an excellent plan for avoiding these mistakes.

Lump-Sum or Annuity?

When you claim your prize money, they will ask you how you want to be paid: lump sum or annuity? The annuity option pays a certain amount for either 20 or 30 years, depending on how big the jackpot is. The payments come once a year, start low, and increase by about 5% per year to adjust for inflation.

The lump-sum option is just that—the whole lump sum in one single payment. However, you won’t receive the advertised jackpot, but roughly half of it. The reason for this is that the jackpot reflects what your prize would be if you chose the annuity payment. So if the jackpot is $400 million, you would get around $200 million before taxes.

What you choose reflects your spending habits and how well you can resist spending the entire pot. Even so, people have been known to go bankrupt even with annuity payments, so your financial future is not entirely guaranteed.

Before you choose, take a look at the benefits and tax consequences of each one, as well as the horror stories and success stories of past winners who chose each one.

Lump-Sum Benefits

When you choose a lump sum payment, you’re getting the entire amount all at once. The main benefit is that you only pay taxes on it once, and then you are free to do with it as you wish.

The other benefits include:

- You have more money to invest in low volatile, dividend-paying stocks. The more principal you have to begin with, the more money you will earn interest or dividends on.

- Independent variables later down the road will not affect the money you get now. These variables may include how well the stock market does, or if the state you won the lottery in stops paying out cash for some reason.

- You have full control of all your money, which may also be a disadvantage if you have poor money management skills.

The other thing you can do with the money if you receive it all at once is to leave it in the bank in an interest-bearing savings account. But be careful—if you spend it all, it’s gone. Completely. And you may have high tax bills for which there would be no more money.

Annuity Benefits

An annuity payment per year ensures that you have a good income for at least 20 years if you’re wise and don’t spend it all right when you get it. A few past winners blew their yearly payment immediately (or within a few months) of receiving their payments. But otherwise, if you win a substantial prize, you should be set with an annuity for most of your life.

Benefits of annuity include:

- If you mess up and spend all your cash in one year, you have another year to fix your mistake. Annuity payments are best for those who have a difficult time leaving their winnings alone for the long term.

- You may end up in a lower tax bracket than you would if you took all your cash. Less money per year equals lower taxes, so the amount of taxes you might pay may be lower than receiving a lump sum payment.

- You have a chance to get used to being rich. It is said that it takes around two years to get used to having a lot of money, so if you take your time and don’t spend a lot of money from your annuity payments those first two years, you won’t be as likely to spend it all after that time either.

The great thing about taking the annuity cash option is that you also get closer to the advertised jackpot.

Tax Consequences of Each

Before choosing, be sure to check with your tax advisor about the tax consequences of either choice.

Lump-Sum Taxes

The federal tax rate for any gift or windfall is 25%, no matter what state you live in. State taxes vary but are usually around 5-8%. So if you were to take a lump sum of a jackpot of $1 billion in Wisconsin, of which your payment would be $500 million, you would pay $163.25 million in taxes. That would still leave you with $336.75 million to do with what you wish.

Annuity Taxes

Assuming you won the same jackpot as in the previous example, but you chose the annuity option, you would owe $16.7 million in taxes per year for the life of your payments. But since you would be in a lower tax bracket, you may not have to pay that much per year. Check with your tax advisor before choosing the right option.

Set Up Beneficiaries

What will happen to your lottery winnings, should you still have them when you die? In many states, your money would go to your estate upon your death. When you claim your prize money, you will need to choose what to do with your money should you die before everything is paid out.

Annuity Payments

Most states allow you to set up a beneficiary to keep receiving your payments when you die. Only one is allowed, so if you have multiple heirs you want to leave your money to, you may want to set up separate savings accounts for them before you die so they can get a sizable inheritance.

Lump-Sum Estate

Another benefit of the lump sum payment option is that you can determine where your money goes after you die because you already have it. Therefore, you have complete freedom to leave it for anyone you wish.

Taxes on Your Estate for Heirs

Estate taxes only kick in on the federal level when the size of the estate is worth more than $11.58 million for singles or $23.16 million for couples in 2020. The taxes are deducted from the estate before the beneficiary inherits it. If it is not worth that much, then your heirs may not need to pay taxes on it.Again, check with your tax advisor when you set up your estate in your will, so that you don’t create an undue tax burden on your loved ones.

Maintain Privacy

The first thing you should do before you even claim your prize money is to protect your privacy. Change your phone number, maybe move and get a post office box, and be sure your name is not all over the internet, so scammers cannot find you.

One woman, Mavis Wanczyk, did the exact opposite. She told everyone she knew that she won the lottery, claimed her prize within a few days of winning, and didn’t do anything to protect her privacy.

She regretted that decision later after she was the subject of several social media scams. Don’t do that.

Change Your Phone Number

Most states require an address and phone number to claim your prize. While your phone number may not be publicized, it is fair game for the media to find you if it is in the claim office. Once you receive your prize, change your phone number. Doing this will make it more difficult for people to find you.

Google Your Name

Look up your name online. Chances are, your name, address, phone number, and possible relatives are listed on several sites. Change the information before going public with your prize. You don’t need to be completely truthful on these sites. Maybe change your address to 1313 Mockingbird Lane, unless you live at that address.

The takeaway is that you need to protect your privacy at all costs if you win the lottery so that people will be expecting a handout.

Conclusion

When you win the lottery, there will be a whirlwind of activity all at once, including settling all the questions you need to answer. If you’re not careful, you may end up like some of the past winners who blew it all, then committed suicide.

You want to ensure you have a great team to handle everything that comes with winning a massive jackpot, and you want to take care of your physical and mental health so you can enjoy your new-found wealthy lifestyle. Just don’t blow your money in a few years, and you will avoid that “dreaded curse” of the lottery.