Where Does Lottery Money Go?

Let’s face it, gambling is a vice, and playing the lottery is gambling. But you’re thinking it’s surely not so bad if the money you stake goes to a good cause. You believe that lotteries use the money from ticket sales to fund public services, but you’re not sure.

Lottery money goes to a few different places. Part of your ticket price is used to fund state programs. However, before the lottery pays anything to those programs, it makes various deductions. These deductions pay for the costs of running the lottery, as well as payments to prize winners.

You probably suspected things wouldn’t be straightforward, and now you want to know the details. Well, you’ll find more information on how lotteries divide up the proceeds from your lottery ticket below. So, get comfortable and read on.

Who Runs the Lottery?

Lotteries Are a State Monopoly

Let’s cover some basics first. You’re probably aware that in the US, individual states run lotteries. It’s not left to private companies. Since state lotteries don’t need to keep shareholders happy, they can use their profit for the good of residents in the state.

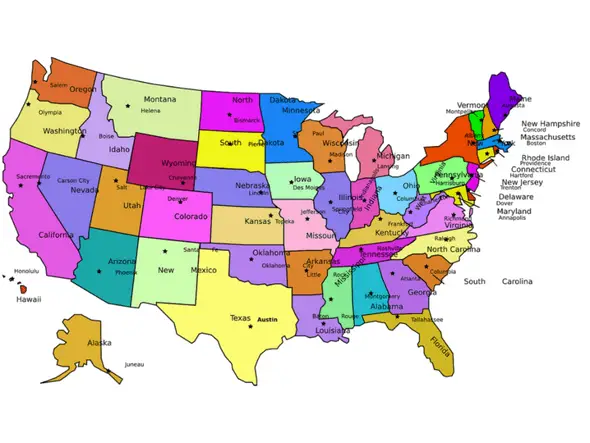

Apart from Alabama, Alaska, Hawaii, Nevada, and Utah, all states run a lottery. Mississippi introduced its lottery as recently as 2019.

Although the lotteries are state-owned, a handful of states, including New Jersey, have outsourced all or part of the management of their lotteries to private companies.

How Did the States Get Involved in Lotteries?

Well, believe it or not, the states’ involvement in lotteries in the US dates back to colonial times.

In 1612 the company that settled Jamestown, the Virginia Company of London, received a royal charter to hold lotteries. The funds it raised were for the company’s continuing operations in Virginia.

Subsequently, other colonies used lotteries to fund their establishment and development, providing infrastructure and public buildings. Lottery proceeds also helped finance the development of Harvard, Yale, and Princeton.

However, throughout these years, lotteries had a somewhat chequered history as scandals and corruption undermined public confidence. By the end of the 1800s, they were no longer legal.

It wasn’t until the middle of the 20th century that they burst back to life when the New Hampshire Lottery began operations in 1964. Other states soon followed. Now, lotteries run in 45 states plus the District of Columbia.

So, lotteries to fund the state’s activities are nothing new. But the modern-day versions most definitely do it on a grander scale than their colonial predecessors could ever have imagined.

According to US Census Bureau 2018 figures, the forty-four lotteries operating that year reported a total income, excluding commissions, of over $76 billion. That’s $325 per adult based on the 2018 Census Bureau population figures.

How Does the Price of a Lottery Ticket Break Down?

So, history lesson over, let’s get down to it and get into the detail of where the money goes.

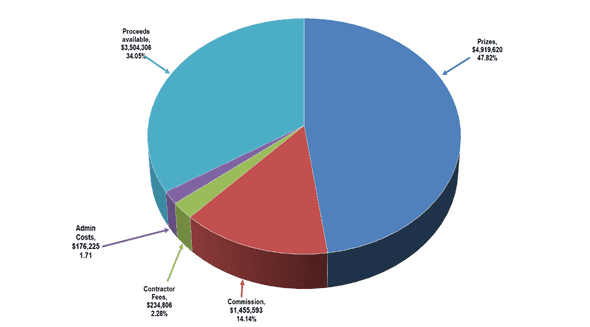

By way of example, we’ll use figures from the New York Lottery’s 2019 Financial Statements so that you can get a general idea. Here’s how it looks:

As you can see, lotteries allocate the bulk of the cost of a ticket to prize money. Next in size is the amount available for state programs after paying the costs associated with running the lottery.

The figures and the allocations will vary from one lottery to another. Still, the general picture should be the same, even though some lotteries do pay less in prizes than they retain for state programs.

You can see this from the 2018 figures issued by the Census Bureau. According to those figures, Delaware, Oregon, Rhode Island, South Dakota, and West Virginia paid less in prizes than they retained in that year.

So, let’s look at the breakdown in more detail.

Administration Costs

As you’d expect, with any business, there are costs related to its operations, and lotteries are no different. In general, lotteries incur similar types of expenses in this category, including:

- Marketing and Advertising. As a lottery’s business is the sale of lottery tickets, it incurs marketing and advertising costs in promoting sales.

- Staffing. Lotteries are employers, so they have to pay salaries, vacation pay, and pension contributions.

- Expenses for instant ticket games. Instant ticket games, or scratchcards, are physical items, so there’s a cost associated with the printing of these.

- Leasing costs. Lotteries occupy premises and rent equipment as part of their operations.

So, that’s a general idea of the type of expenses involved in running a lottery. These expenses tend to represent a modest proportion of ticket sales.

However, there is variation between lotteries, as the 2018 Census Bureau figures illustrate. The percent of revenue taken up by administration costs can be in the low single digits. But for some lotteries, it’s a lot higher.

Commissions and Fees

Retail and Gaming Facility Commissions

Most lotteries don’t have online sales facilities, and even those that do still rely on a network of licensed retailers to sell tickets to the public.

Generally, retailers earn a commission of around 6% for each ticket they sell. Lotteries proudly proclaim that by selling through local retail outlets, they support local businesses.

The New York Lottery’s 2019 Financial Statements mentions a network of 17,500 retailers selling lottery tickets and scratchcards on its behalf. It paid these retailers $492 million in commissions in 2019, which was 6% of revenue.

That works out at an average of $28,000 per retailer. Compare that to the average weekly wage in New York state for 2019 of $1,450. Annually, that works out at $75,400, so the retailer commissions paid by the lottery represented 37% of the state’s average wage.

New York’s lottery, in addition to selling lottery tickets, also provides video lottery terminals within various facilities in the state. So, as well as paying retail commissions for the sale of lottery tickets, it also pays commissions to gaming facilities hosting the video lottery terminals.

These commissions tend to be a higher percentage of the video gaming income element of the revenue. In 2019, the New York Lottery reported that these commissions amounted to 46.3% of video gaming income. In monetary terms, that amounted to $964 million.

Contractor Fees

As the lottery system is computerized, each lottery has a service provider running the system on its behalf.

The New York Lottery also has a contractor running the network of video lottery machines. But, for most lotteries, fees will only relate to the running of the centralized computer system.

The fee payable is a percentage of sales.

Prize Money

Why is Prize Money the Largest Proportion of the Ticket Cost?

As you saw from the chart above, prize payouts, at least in most cases, represent the largest share of the proceeds of lottery sales.

It seems contrary to the purpose for which states run lotteries, namely, to raise funds for public expenditure.

However, prize money is what attracts players, and ticket sales are the source of the lotteries’ revenue. So, lotteries face a delicate balancing act between incentivizing players and providing funding for state projects.

Who Decides How Much Lotteries Pay Out as Prize Money?

It’s for each lottery to decide how to apportion its revenue.

You can see from the Census Bureau’s 2018 figures that the average prize payout as a percentage of revenue, excluding commissions, was 64.5%. On the other hand, money retained by the lotteries’ state programs was, on average, 31% of revenue.

Within those averages, there are, sometimes, wide variations between states.

For example, North Dakota spent 75% of revenue on prize money and retained only 4.58%. In contrast, West Virginia only paid out 17% of its revenue in prizes, keeping 78% for use by the state.

How Can I Find Out How Much of the Ticket Price Goes Towards Prizes?

You can often find out how much of the ticket price a lottery allocates to prize money by checking the game rules and information.

For example, let’s look at the New York Lotto game. The information provided states that the lottery allocates 40% of ticket sales to the prize fund. So, $0.40 of the $1 ticket price is set aside for payment of prizes, including the jackpot.

The amount set aside for prizes varies depending on the game. If you want to know, you can trawl through a state’s lottery laws to find the details.

In the case of the New York Lotto, for example, the state’s Gaming Commission rules and regulations contain provisions for each game.

| Game | Percent of Gross Sales for Prizes |

| New York Lotto | 40% |

| Mega Millions, Powerball, Pick 10, Take 5, Win 4, Numbers | 50% |

| Quick Draw | 60% |

| Scratchcards | 65% |

Can These Limits Be Changed?

Well, the state could change the provisions that set these limits if it wanted to reduce or increase them.

However, some lotteries’ rules allow them to add to the prize fund for any particular draw, without breaching the type of limits set out above.

Increasing Prize Funds

Just to be clear, the percentages referred to above relate to ticket sales for a particular drawing. But, New York’s state law allows the lottery to increase the prize fund for a draw using unclaimed prizes from previous draws.

What’s an unclaimed prize? Well, each lottery sets a time limit within which a winning player must claim. In New York, the time limit is one year from the date of the drawing, but the time limit may be different in other states.

So, once the time for claiming has expired in New York, the prize money has to be paid into the state lottery fund. The lottery can then use the funds to supplement prizes in subsequent games.

Other states may require the use of unclaimed prizes for the state programs designated to receive lottery funds. For example, Michigan state lottery law provides for its lottery to pay unclaimed prizes to the lottery’s beneficiary, the state school aid fund.

Whatever the rules, they’ll apply equally to unclaimed Mega Millions and Powerball winnings. Those multi-state lotteries return unclaimed prizes to each participating lottery in proportion to their sales for the draw in question.

Surprisingly, the levels of unclaimed prizes can be quite high. In its 2019 financial year, the Michigan Lottery reported $40.6 million in unclaimed prize monies. The figure for the New York Lottery was $599 million.

So, in New York, unclaimed prizes find their way back into the prize pool. In a state like Michigan, however, the lottery’s designated beneficiary gets the benefit. Some may say that Michigan’s policy for dealing with the situation is more consistent with the overall objective of state lotteries.

What You See Isn’t Always What You Get

It may surprise you that those headline-busting jackpot figures you see in the press aren’t always what they seem.

If you’re lucky enough to win big, be prepared, because you may be in for a shock.

That’s because US lotteries advertise many prizes based on the value of the winnings being taken as an annuity over 25-30 years. If you select the lump sum cash option, your winnings can be substantially less than the advertised amount.

The cash option represents the money that’s in the jackpot prize fund. The annuity value is an estimate of what that cash amount is worth over the installment period.

Mega Millions shows the annuity and cash values of its current jackpots on its website, as does Powerball. However, it’s the higher annuity value that you’ll see in the press hype when the big rollovers occur.

Mega Millions has a list of the annuity and cash values of previous jackpots on its jackpot history page. It gives an indication of the difference between the two options. However, annuity values will always depend on annuity rates at the time the annuity is bought.

The upshot is, don’t be fooled by the headline figures. If you go for the cash option, you’ll receive less than the headline amounts.

The Government’s Cut

But that’s not all. Whichever way you decide to take your jackpot prize, there’ll be a federal tax liability. Additionally, depending on the state in which you live, you may have to pay state tax.

Your winnings will be taxed as income, whether you choose the annuity or lump sum. That’s because it’s the source of the win, not the form of the payment that determines its tax treatment.That’s right. Your favorite uncle, Sam, is going to come knocking. So, if you win over $600 in the lottery, you’ll have to include that in your next federal income tax return. And state income taxes may also be due if you live in certain states.

Now, this isn’t great if you’re the lucky winner. But if you’re concerned that lotteries allocate too high a proportion of revenues to prize money, you may now feel a little better.

So, let’s look at the taxes.

Federal Tax

The bad news for winners is that the lottery will usually report wins of $600 or more to the IRS. If your winnings are $5,000 or more, the lottery is obliged to retain federal withholding tax before it hands over your winnings.

The lottery withholds this at 24% straight off. But if your winnings are substantial, your ultimate liability may put you into the top income tier where the rate is 37%.So, federal taxes can add up to considerable sums. For example, take the South Carolina woman who won $1.5 billion in 2018 and chose the cash option. The lottery would have had to deduct about $210 million to meet just the 24% withholding requirement.

It’s not a bad windfall for the federal purse, with more to follow later since the 37% tier would also have applied.

State Tax

And it doesn’t end there. Quite apart from the federal tax liability, you may also end up paying state taxes on your winnings.

If you’re lucky, you’ll live in a state that doesn’t impose income taxes and doesn’t tax lottery wins, such as Florida, Texas, and Wyoming, to name a few.

California is one state that does have an income tax but doesn’t tax lottery winnings.

However, if you live in a state that does tax lottery winnings, the tax payable will depend on your state of residence. And, as with federal taxes, the lottery will withhold state tax before you get your prize.

The rates range from 2.9% in North Dakota to 8.82% in New York. If you live in New York City or Yonkers, you’ll also have to pay local taxes in addition to the state tax. That’ll add another 3.876% and 1.477%, respectively, to your tax bill.

Looking again at that big South Carolina jackpot winner who took her $1.5 billion prize as a lump sum, her state tax liability came to about $61 million. This windfall enabled the state to include a rebate to taxpayers in its 2019-2020 state budget, effectively sharing the winner’s good fortune.

So, if you’re a winner, you’ll need to brace yourself for the tax liabilities you’ll incur. As you’ve seen, they could be substantial. But, if you win big, you’ll still be left with a hefty sum, so you shouldn’t really complain.

And if you’re someone concerned about the amount of money going into lottery prize pools, you can hopefully rest assured. Some of that prize money ends up back in the public purse at federal and, in some cases, state level in the form of taxes.

Other Government Recoveries

Yes, there’s more.

In addition to taxes on the amount of your prize, some lotteries deduct past overdue federal and state taxes and child support.

Additionally, they may be obliged to retain the amount of any public assistance, such as food stamps or Medicaid, you may have received previously. Here are some examples of lotteries that do this:

- The New York Lottery makes deductions for outstanding taxes, child support, and past public assistance benefits if you win $600 or more.

- The Wisconsin Lottery deducts outstanding child support, but only if your lottery winnings exceed $1,000.

- The Michigan Lottery is obliged, under state law, to make certain deductions if you win $1.000 or more.

As you can see, the cumulative effect of all of these deductions is that the government benefits to a significant extent from lottery winnings.

The figures you’ve seen above for the sums paid out as prize money don’t reflect the taxes or these recoveries. So, it’s worth bearing in mind if the amount of prize money lotteries give away concerns you. The lucky winner doesn’t necessarily get their hands on the whole lot.

Available Proceeds

And that brings us to the very purpose for which lotteries exist, namely to provide funding to benefit the states in which they operate.

You’ve probably got the picture already, but each state determines the laws and rules regulating the conduct of its lottery. That includes deciding where the proceeds go.

How Do Lotteries Use Their Profits?

Some states are very specific about the purpose to which they apply lottery proceeds. Others may only require payment of lottery profits into state funds for general use.

Take the New York Lottery again, by way of example. It’s one of those lotteries that specify the beneficiary of its profit. The money goes to the state lottery fund, which provides aid to the state’s elementary and secondary education systems. State laws dictate how much of the revenues from various games the lottery must pay into the lottery fund.

In 2019, the New York Lottery paid nearly $3.5 billion to the fund, which was 13% of the total 2018-2019 school aid budget.

In contrast to the New York Lottery, the Wyoming Lottery doesn’t support a specific program. It pays the profits from the sale of tickets into a general state fund. From there, the state distributes the money to towns and cities, and they decide how to use the funds. In 2018-2019, the amount transferred from the lottery was $6.6 million. With a population of about 580,000, that works out at $11.38 per resident.

Other lotteries use their profits to support several identified causes. For example, Nebraska’s lottery provides funds for its state fair, environmental and gamblers’ assistance programs, and education improvement.

How Much Lottery Money is Used for State Funding?

As mentioned above, the percentage of sales each lottery retains for allocation to its designated causes varies.

You’ve seen the range of the figures in 2018, based on revenues after deducting commission.

The data shows North Dakota retaining only 4.58% of income after commissions in that year. At the other end of that range, West Virginia kept about 78%. But the average in 2018 was around 30%.

Now, 30% doesn’t sound like a great deal. When you look at those 2018 Census Bureau lottery figures and the 2018 population data, you can see what it means in monetary terms.

The total revenue net of commissions works out at an average spend on tickets across the forty-four lotteries of $233 per person. That compares to an average of only $72 per person of funds available for distribution.

How Is That Justified?

Well, we come back to the problem identified earlier. It’s a question of striking a balance between competing objectives.

The first is to provide funds for the state. The second is to provide enough incentive, that is, prizes, to encourage players to shell out on a ticket.

It’s no surprise that the use of lotteries to provide public funding has long been a source of controversy. But, lotteries don’t appear to be going away for the time being. After all, Mississippi only introduced its lottery in 2019.

In fact, Alabama, one of five hold-out states, introduced a bill in March 2020 seeking approval for a state lottery.

In the end, it may be unlikely that any state with a lottery will turn it’s back on the income. The simple reason is the alternative appears to be raising taxes to provide replacement funding. It would take a brave state legislature to make such a proposal.

And let’s not forget that some states do benefit from taxes and other recoveries of public expenditure when a resident wins.

Conclusion

Setting aside the controversy, hopefully, you now understand where the lottery goes. To recap, generally, the breakdown is:

- Administration Costs — 2%

- Marketing and advertising

- Salaries and pensions

- Expenses for instant ticket games

- Leases for property and equipment.

- Commissions and Fees — 16%

- Retailer and gaming facility commissions

- Contractor fees

- Prize Money — 48%

- Less federal withholding tax

- Less state withholding tax where applicable

- Other government recoveries

- Profit distributed for state programs — 34%

Although the most significant slice of the pie is allocated to prize money, a good proportion gets returned to public funds through taxes and other government recoveries.

So, there are good and bad things about lotteries being used for public funding.

As lotteries seem to be here to stay, at least for a while, focus on the good when you have your flutter and savor the momentary dream.