How to Stay Anonymous as a Lottery Winner?

If you’re lucky enough to win big on the lottery, there’ll be many things you need to consider as you digest the enormity of your good fortune. But wherever there’s money, there’ll be people who will try to take advantage of you. You’d think the obvious solution is to keep your win quiet, but you may find that’s easier said than done.

If you want to stay anonymous as a lottery winner, you should negotiate with the lottery explaining why you need to avoid publicity. If that fails, take legal action to enforce your privacy by claiming winnings through a trust or setting up an LLC to claim the money.

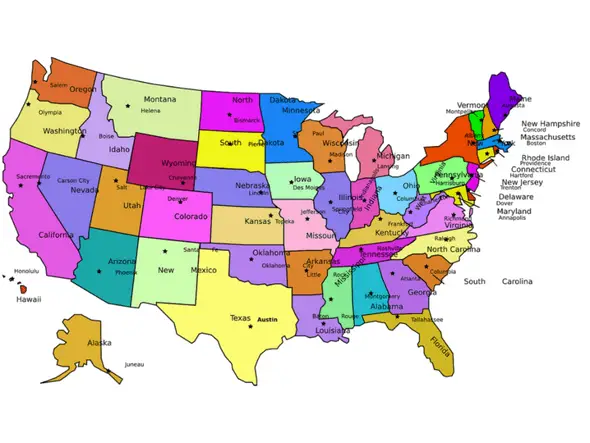

Every state has its own rules on the confidentiality of winners’ details. So, it’s essential to check the specific provisions. You should always seek specialist legal advice. But, from this article, you’ll get a good understanding of how to stay anonymous if you win the lottery.

Why Would You Want to Stay Anonymous?

Before we look at how you can try to keep your privacy, let’s consider why you may want to do so. We’ll also look at why some lotteries insist on publicity.

Imagine if you were lucky enough to win a lottery jackpot. If it’s a large sum, the press will likely hound you for your story. You’d also have financial and other advisors trying to get you to become their client. Then, there’s the problem of charities, family, and friends, trying to get money out of you.

All will be looking to share in some way in a piece of your enormous financial pie.

And what about new people coming into your life? You’d always be wondering if it’s you or your money that they’re after.

At first, you may be OK with all this. You may even enjoy the attention. But there’s little doubt that it could become tiresome, to say the least, after a while.

It’s also a sad fact that having a lot of money can attract more sinister attention. Kidnappers tend to target people with money, and instant wealth is a magnet to scammers.

We’ve all read the tragic stories of lottery winners duped and sometimes killed for their money.

It’s hard to believe that a positive life-changing event like a big win on the lottery could end so badly. So, it’s no wonder that many lottery winners would rather keep their sudden good fortune private.

What’s the Argument Against Anonymity?

The lotteries argue that it’s all about transparency. Lotteries are state-run, and to operate effectively, people need to have confidence in the way they conduct their business.

So, they need to see that real people, just like themselves, do win and do win big. It’s reassuring to see ordinary people winning as it proves the lottery isn’t a con.

After all, the money state lotteries pay in prizes is public money. So, people have a right to know where it’s going.

Lotteries argue that by publicizing the winners’ details, they gain the trust of the people on whose support they rely. It’s people spending money to buy tickets that enable lotteries to raise funds for the state’s benefit.

Undoubtedly, for the lotteries, the publicity isn’t just a question of transparency. It also provides cheap and effective PR for the lottery, increasing interest, and boosting sales.

Can I Choose to Stay Anonymous?

Would it surprise you that the answer to this question is no? At least not in most states. That’s right, whether you can choose anonymity is itself something of a lottery.

Let’s look at how the rules differ depending on where you live.

Which States Allow You to Stay Anonymous?

Some states allow you to remain anonymous, whatever the amount you win. In others, you can keep your information private only in certain situations.

Unconditional Anonymity

The lotteries in the following states give you the right to remain anonymous:

- Delaware. Delaware state law permits lottery winners to remain anonymous.

- Kansas. The Kansas Lottery will honor requests for winners’ details to remain private.

- Maryland. The Maryland Lottery only releases details of winners of draw games and scratchcards with consent. But, this doesn’t apply to certain promotional games, where the rules state that the lottery can publish winners’ names.

- New Jersey. New Jersey changed its laws in January 2020 to give winners the right to keep their details private.

- North Dakota. In North Dakota, winners can choose not to have their details released.

- South Carolina. The lottery in South Carolina has a policy allowing winners to remain anonymous. The 2018 winner of the giant $1.53 billion jackpot was able to avail herself of this policy.

- Wyoming. The Wyoming Lottery encourages winners to share news of their good fortune, But, it states that it will honor privacy requests.

- Mississippi. Mississippi is the newest state lottery, only having started in 2019. Its lottery law prevents it from disclosing winners’ details without their written consent.

Anonymity in Certain Circumstances

Anonymity Depending on the Amount of Your Win

In the states below, a winner can keep their information private if their win is of a specific size. There may also be other requirements that apply.

- Arizona. Since April 2019, Arizona has allowed winners of $10,000 or more to remain anonymous. However, the winner must request anonymity. If they don’t, the lottery keeps their details private for ninety days from the award of the prize. The 90-day provision also applies to wins of between $600 and $10,000.

- Georgia. Georgia amended its state lottery law in May 2018. Now, lottery winners of $250,000 or more can request their information remain confidential. The provision applies to both state and multi-state winnings.

- Michigan. Michigan state lottery law allows its winners to remain anonymous if they win $10,000 or more. The provision doesn’t apply to winners of the multi-state lotteries, Mega Millions or Powerball. But, a House bill introduced in late 2019 aims to extend the law to those multi-state lotteries. The Senate had introduced a similar bill in January 2019.

- Texas. The law in Texas allows anonymity if the win is $1 million or more, taken in a lump sum. But, if the winner takes the annuity option, anonymity only lasts for thirty days from the date of the claim. The law applies whether you claim as an individual or as a beneficiary under a trust.

- Virginia. Since July 2019, lottery winners in Virginia have been able to remain anonymous if their winnings are $10 million or more.

So, there’s some protection in these states if the amount of your win qualifies. But, ensure you follow any procedures the lottery may have. Taking legal advice before you claim your prize is essential to navigating your way through a lottery’s requirements.

What if I Fall Outside of These Limits?

Where you have no or limited rights to anonymity, taking your time to get the right advice before claiming is crucial.

It’s easy, with the excitement of winning a large amount of money, to get carried away. You may think you have no choice but to agree to the lottery’s requests for photos and press conferences.

You may even feel like you owe it to the lottery to do so for giving you this incredible windfall. However, resist the impulse because, as the saying goes, we do in haste what we repent at leisure.

Take a step back and get independent advice. There may still be things that you can do to keep your details private.

So, let’s consider the options for staying anonymous if none of the above apply to you.

Staying Anonymous in Other Circumstances

If your ticket isn’t from a state that gives you anonymity, or you don’t fall within the conditions set by a state, don’t despair. There are still some strategies you can employ to keep your information private.

The first thing you should do, however, is to ensure that you tell as few people as possible of your win. The more people who know, the higher the risk of the news spreading and getting beyond your control.

Secondly, keep a low profile. Don’t attract attention to yourself with big spending sprees. Sudden conspicuous consumption is a sure-fire way of giving yourself way.

So, as far as possible, keep your win under wraps and keep a low profile while you get the advice you need.

Once you’ve taken a deep breath and calmed yourself, here are some options for keeping your win private.

Negotiation

Some lotteries, like California, will publish winners’ names. But, it’s always worth approaching the lottery first to discuss your desire for privacy. If there’s a pressing reason for your wish to keep your details private, you may be able to avoid the publicity.

For example, Oregon considers a winner’s details to be a matter of public record, so there’s no anonymity.

However, in 2015, the Oregon Lottery granted anonymity to a man from Iraq who won the $6.4 million Oregon Megabucks jackpot. The lottery agreed not to disclose his details for safety reasons, as the man was still living in Iraq.

In Idaho, state law requires disclosure of some details of lottery winners if a state resident makes a request for that information. That information includes the winner’s name, the amount of their win, and place of residence. But, the lottery’s Winner’s Guide says that if a winner requests no publicity, it will consider that request.

North Carolina’s lottery is another that treats winners’ details as public information. But, it won’t disclose the information if the winner has a protective order or belongs to the state’s Address Confidentiality Program.

So, even in states that treat winners’ details as public information, it’s always worth checking the rules for any exceptions. You’ll need to do this before you claim your winnings.

Special Circumstances

In December 2015, an Iraq citizen won the $6.4 million jackpot in Oregon Lottery. The lucky winner bought his ticket with the help of a lottery courier service. To keep him and his family safe, lottery officials honoured his request to stay anonymous.

So, even if you can’t find any exceptions, you can just ask the lottery. They may be prepared to work with you where possible.

If that fails, what’s next?

Litigation to Enforce Your Right to Privacy

The Basis of Legal Action

If negotiation and persuasion don’t help, ask the courts to assert your right to privacy.

As you’ve seen above, there are two competing arguments regarding the anonymity issue for lottery winners.

On the one hand, you have the individual’s right to privacy. On the other, there’s the public’s right to know where public money goes. That right ensures people can trust the lottery is conducting its business with integrity.

It’s possible that despite a lottery’s insistence that winners’ details are a matter of public record, courts will still sympathize with you.

The New Hampshire Case

Take the case of the New Hampshire women who won a whopping $560 million Powerball jackpot in January 2018.

Following instructions on the lottery’s website, she had signed her winning ticket.

When she sought anonymity, the lottery told her that signing the ticket in her name meant it had to make her name public.

She hadn’t realized that the signing of the ticket in her name would deprive her of her anonymity.

New Hampshire is one of those states that allow winners to claim through a trust. So, the winner should have signed the ticket in the name of a trust. Then, the lottery would only have had to make public the trust’s name, not hers.

The women took the matter to court. She enjoyed an active role in her community, which she didn’t want to give up. Her case was that the publicity surrounding her win would create an intolerable situation. It would leave her open to harassment, scams, and a constant barrage of people asking for handouts. She wouldn’t be able to go about her ordinary business within her community and participate in community events.

The judge found in the woman’s favor. He considered that her interest in maintaining her privacy outweighed the public’s right to know.

The judge noted that the lottery’s rules allowed winners to claim through a trust to hide their details. So, the lottery’s argument that the public had a right to know the recipient’s identity didn’t entirely wash.

Consequently, the woman was able to collect her winnings and remain anonymous, much to her relief.

Despite the state’s laws requiring publication of winners’ details, the lottery didn’t appeal. It said that it was a matter for the state legislature to address.

Can This Case Help Outside New Hampshire?

The lottery founded its argument on public record laws that operate in all states in one form or another.

So, a judge in another jurisdiction might reach the same conclusion as the New Hampshire judge.

But, state laws differ, so you’d need to get expert local advice before considering taking this route. Litigation can be costly and stressful, and if you can avoid it, you should.

So, let’s have a look at other options to keep your anonymity.

Claim via a Trust

As you saw in the New Hampshire case, some states allow lottery winners to claim winnings through a trust.

What Is a Trust?

A trust is an agreement contained in a deed and is used as an asset management tool. The agreement sets out the arrangements for managing specified assets.

There are three parties involved. The trustee handles dealing with the assets. The settlor provides the assets that the trustee will manage under the trust. Finally, there’s the beneficiary, who receives the benefit of the trust assets.

New Hampshire isn’t alone in allowing lottery winners to use trusts to hide their identity.

Ohio is another example of a state where lottery winners can claim their prize through a trust. State law requires the trustee to supply full details of the beneficiaries of the trust. But the lottery commission can’t disclose those details as they are confidential.It’s important to note that the confidentiality of the details only applies if the trustee claims the winnings, not the beneficiaries. So, you need to ensure you follow this rule, so you don’t jeopardize your claim to anonymity.

How Does Using a Trust Provide Anonymity?

The purpose of a trust for lottery winnings is to hide your name. Obviously, the name of the trust should be such that you’re not identifiable from it.

You write the trust’s name on the back of the winning ticket. So, the trust becomes the owner of the ticket. Consequently, it’s the trust, through the trustee, that claims the prize. Now, the name of the trust appears as the winner.

Another state that allows you to stay anonymous in this way is Vermont. Its FAQ section explains that using a trust makes the trust’s name the information of a public record.

How Do You Set Up a Trust?

The process for setting up a trust may vary from state to state. That’s why it’s essential to get expert legal advice specific to the state in which you’re claiming.

Generally, you appoint a trustee to administer the assets placed in the trust. The assets of the trust are your lottery winnings. The trustee is usually an expert advisor, like an attorney.

Although your details will be in the trust document as the settlor and beneficiary, those details remain hidden. That’s because the trust claims the prize, not you, the beneficiary.

Does It Work in All States?

Now, a note of caution. Some states that allow trusts to claim winnings, treat the beneficiaries’ details as part of the public record. So, a lottery, if asked to produce the data, would do so.

This is the case in Tennessee. The lottery’s view is that on receipt of identity documents for the settlor and beneficiary, a record comes into existence. The lottery views that record as public. So, it must make them available if requested under the state’s Open Records Act.

So, in Tennessee, a trust won’t protect your anonymity.

You’ll find the position is the same under North Carolina’s state laws. So, details of trust beneficiaries would be accessible.

In other states, the position isn’t always clear, which is why getting expert advice before you claim your prize is crucial.

Claim via a Limited Liability Company

Set Up an LLC to Claim the Prize

An alternative to a trust is a Limited Liability Company or LLC. It may be an option in states like Tennessee and North Carolina, where details of trust beneficiaries are public records.

It was the option used in New York by a group of workers in the state. Using an LLC to claim their prize, they were able to keep their identities secret when they hit a $437 million jackpot in 2019.

The workers opted to claim their winnings through an LLC after reading comments the state’s Governor had made. He had vetoed a bill that would have given lottery winners anonymity. In doing so, he had remarked that previous winners had used LLCs to hide their identity.

Indiana state law also allows LLCs to claim lottery winnings. The 2016 winners of a $536 million jackpot used one to keep their identities hidden.

In some states, the lottery may make no mention of whether you can use an LLC to claim winnings.

Nebraska is an example. Its laws make lottery winners’ details a matter of public record to which anyone can request access. But in 2014, a $1 million winner claimed the money anonymously using an LLC.

This example goes to show the importance of getting professional advice before you claim your prize.

Interestingly, in January 2020, a Nebraska lawmaker introduced a bill to give anonymity to lottery winners of $300,000 or more.

Select the State in Which You Set Up Your LLC Carefully

If you’re thinking of claiming winnings using an LLC, it’s vital to get proper advice. That’s because most states require information about the individuals behind the LLC to be filed as part of the setup process.

The information would then be a matter of public record that anyone could access, defeating your goal.

However, some states don’t require such information, like Delaware and New Mexico. Consequently, your details don’t become part of the public record when setting up an LLC in those states.

Additionally, neither Delaware nor New Mexico requires LLCs to file annual reports. Annual reports contain owners’ personal information. So, with no filing obligation, these states may be a good option for privacy purposes, even if you live in another state.

In other states, you may not need to give your personal information on setup. But, if the state requires the filing of annual reports, your details will appear in those documents.

These types of nuances underline why you should always seek expert advice before you decide on the best way forward. Also, laws and requirements can change. A local expert advisor will keep abreast of relevant provisions and be able to advise fully at the time you are looking to claim.

However, some states’ laws preclude legal entities from claiming lottery winnings altogether.

Virginia is an example of this. Its laws provide that only natural persons, that is, only human beings can buy lottery tickets or claim winnings.

So, if you buy your lottery tickets in a state like Virginia, you’re going to have to re-think if privacy is important to you.

Buy Tickets in a State That Allows Anonymity

The rules on anonymity depend on where you buy your ticket and not where you live. So, if you value your anonymity and don’t want the rigmarole of setting up trusts and LLCs, buying tickets in states that grant complete anonymity makes sense.

Since each lottery requires you to buy tickets from licensed retailers, you need to be able to get to the state to purchase the tickets. That’s the drawback here.

Buying online doesn’t seem to be an option. Those few lotteries that allow online sales require you to register an account with an in-state address before making online purchases.

So, this option is only feasible if you live within at least driving distance of a state that will allow you to maintain total anonymity.

To recap, that’s Delaware, Kansas, Maryland, New Jersey, North Dakota, South Carolina, or Wyoming.

As mentioned above, Virginia state law precludes the trust and LLC options for claiming your winnings. So, if you live in Virginia, you might consider buying tickets in Maryland if you live close enough to that state.

Conclusion

So, you now have some idea of the options available if you want to stay anonymous as a lottery winner.

But, the most critical thing you can do from the outset is to get professional expert advice as soon as possible. You should do this before you claim your winnings and before you start shouting about your good fortune.

Lottery laws, rules, and regulations are state-specific. They’re a potential minefield, which is why you need to tread carefully.

Use the time that you have to make your claim wisely by getting the right advice. That will give you the best possible shot at ensuring the blessing of your good fortune doesn’t become a curse.